What Is Inflation?

Price increases, or inflation, may be thought of as the gradual loss of buying power. The average price rise of a selection of products and services over time can serve as a proxy for the pace at which buying power declines. A unit of currency effectively buys less as a result of the increase in prices, which is frequently expressed as a percentage. Deflation, which happens when prices fall and purchasing power rises, can be compared to inflation.

KEY TAKEAWAYS

- Inflation is the rate at which prices for goods and services rise.

- Inflation is sometimes classified into three types: demand-pull inflation, cost-push inflation, and built-in inflation.

- The most commonly used inflation indexes are the Consumer Price Index and the Wholesale Price Index.

- Inflation can be viewed positively or negatively depending on the individual viewpoint and rate of change.

- Those with tangible assets, like property or stocked commodities, may like to see some inflation as that raises the value of their assets.

Understanding Inflation

While it is easy to measure the price changes of individual products over time, human needs extend beyond just one or two products. Individuals need a big and diversified set of products as well as a host of services for living a comfortable life. They include commodities like food grains, metal, fuel, utilities like electricity and transportation, and services like health care, entertainment, and labor.

Inflation aims to measure the overall impact of price changes for a diversified set of products and services. It allows for a single value representation of the increase in the price level of goods and services in an economy over a period of time.

Prices rise, which means that one unit of money buys fewer goods and services. This loss of purchasing power impacts the cost of living for the common public which ultimately leads to a deceleration in economic growth. The consensus view among economists is that sustained inflation occurs when a nation’s money supply growth outpaces economic growth.

To combat this, the monetary authority (in most cases, the central bank) takes the necessary steps to manage the money supply and credit to keep inflation within permissible limits and keep the economy running smoothly.

Theoretically, monetarism is a popular theory that explains the relation between inflation and the money supply of an economy. For example, following the Spanish conquest of the Aztec and Inca empires, massive amounts of gold and especially silver flowed into the Spanish and other European economies.3

Since the money supply rapidly increased, the value of money fell, contributing to rapidly rising prices.

Inflation is measured in a variety of ways depending upon the types of goods and services. It is the opposite of deflation, which indicates a general decline in prices when the inflation rate falls below 0%. Keep in mind that deflation shouldn’t be confused with disinflation, which is a related term referring to a slowing down in the (positive) rate of inflation.

Causes of Inflation

An increase in the supply of money is the root of inflation, though this can play out through different mechanisms in the economy. A country’s money supply can be increased by the monetary authorities by:

- Printing and giving away more money to citizens

- Legally devaluing (reducing the value of) the legal tender currency

- Loaning new money into existence as reserve account credits through the banking system by purchasing government bonds from banks on the secondary market (the most common method)

In all of these cases, the money ends up losing its purchasing power. The mechanisms of how this drives inflation can be classified into three types: demand-pull inflation, cost-push inflation, and built-in inflation.

Demand-Pull Effect

Demand-pull inflation occurs when an increase in the supply of money and credit stimulates the overall demand for goods and services to increase more rapidly than the economy’s production capacity. This increases demand and leads to price rises.

When people have more money, it leads to positive consumer sentiment. This, in turn, leads to higher spending, which pulls prices higher. It creates a demand-supply gap with higher demand and less flexible supply, which results in higher prices.

Cost-Push Effect

Cost-push inflation is a result of the increase in prices working through the production process inputs. When additions to the supply of money and credit are channelled into a commodity or other asset markets, costs for all kinds of intermediate goods rise. This is especially evident when there’s a negative economic shock to the supply of key commodities.

These developments lead to higher costs for the finished product or service and work their way into rising consumer prices. For instance, when the money supply is expanded, it creates a speculative boom in oil prices. This means that the cost of energy can rise and contribute to rising consumer prices, which is reflected in various measures of inflation.

Built-in Inflation

Built-in inflation is related to adaptive expectations or the idea that people expect current inflation rates to continue in the future. As the price of goods and services rises, people may expect a continuous rise in the future at a similar rate. As such, workers may demand more costs or wages to maintain their standard of living. Their increased wages result in a higher cost of goods and services, and this wage-price spiral continues as one factor induces the other and vice-versa.

Types of Price Indexes

Depending upon the selected set of goods and services used, multiple types of baskets of goods are calculated and tracked as price indexes. The most commonly used price indexes are the Consumer Price Index (CPI) and the Wholesale Price Index (WPI).

The Consumer Price Index (CPI)

The CPI is a measure that examines the weighted average of prices of a basket of goods and services which are of primary consumer needs. They include transportation, food, and medical care.

CPI is calculated by taking price changes for each item in the predetermined basket of goods and averaging them based on their relative weight in the whole basket. The prices in consideration are the retail prices of each item, as available for purchase by the individual citizens.

Changes in the CPI are used to assess price changes associated with the cost of living, making it one of the most frequently used statistics for identifying periods of inflation or deflation. In the U.S., the Bureau of Labor Statistics (BLS) reports the CPI on a monthly basis and has calculated it as far back as 1913.4

Important-The Consumer Price Index For All Urban Consumers (CPI-U) introduced in 1978, represents the buying habits of approximately 88% of the non-institutional population of the United States.56

The Wholesale Price Index (WPI)

The WPI is another popular measure of inflation. It measures and tracks the changes in the price of goods in the stages before the retail level.

While WPI items vary from one country to other, they mostly include items at the producer or wholesale level. For example, it includes cotton prices for raw cotton, cotton yarn, cotton gray goods, and cotton clothing.

Although many countries and organizations use WPI, many other countries, including the U.S., use a similar variant called the producer price index (PPI).7

The Producer Price Index (PPI)

The PPI is a family of indexes that measures the average change in selling prices received by domestic producers of intermediate goods and services over time. The PPI measures price changes from the perspective of the seller and differs from the CPI which measures price changes from the perspective of the buyer.8

In all variants, it is possible that the rise in the price of one component (say oil) cancels out the price decline in another (say wheat) to a certain extent. Overall, each index represents the average weighted price change for the given constituents which may apply at the overall economy, sector, or commodity level.

The Formula for Measuring Inflation

The above-mentioned variants of price indexes can be used to calculate the value of inflation between two particular months (or years). While a lot of ready-made inflation calculators are already available on various financial portals and websites, it is always better to be aware of the underlying methodology to ensure accuracy with a clear understanding of the calculations. Mathematically,

Percent Inflation Rate = (Final CPI Index Value/Initial CPI Value) x 100

Say you wish to know how the purchasing power of $10,000 changed between September 1975 and September 2018. One can find price index data on various portals in a tabular form. From that table, pick up the corresponding CPI figures for the given two months. For September 1975, it was 54.6 (initial CPI value) and for September 2018, it was 252.439 (final CPI value).910 Plugging in the formula yields:

Percent Inflation Rate = (252.439/54.6) x 100 = (4.6234) x 100 = 462.34%

Since you wish to know how much $10,000 from September 1975 would worth be in September 2018, multiply the inflation rate by the amount to get the changed dollar value:

Change in Dollar Value = 4.6234 x $10,000 = $46,234.25

This means that $10,000 in September 1975 will be worth $46,234.25. Essentially, if you purchased a basket of goods and services (as included in the CPI definition) worth $10,000 in 1975, the same basket would cost you $46,234.25 in September 2018.

Advantages and Disadvantages of Inflation

Inflation can be construed as either a good or a bad thing, depending upon which side one takes, and how rapidly the change occurs.

Pros

People who own physical assets (like real estate or stockpiled commodities) that are valued in their native currency may like to see some inflation since it will increase the value of their possessions, which they can then sell for more money.

Due to the expectation of higher returns than inflation, firms and individual investors frequently speculate on hazardous business ventures as a result of inflation.

It is frequently encouraged to have inflation at a set level to stimulate spending rather than conserving. If money’s buying power decreases with time, there can be more of a reason to spend now rather than save and spend later. Spending could rise as a result, which would help the economy. It is believed that a balanced strategy will prevent inflation.

Cons

Buyers of such assets may not be happy with inflation, as they will be required to shell out more money. People who hold assets valued in their home currency, such as cash or bonds, may not like inflation, as it erodes the real value of their holdings. As such, investors looking to protect their portfolios from inflation should consider inflation-hedged asset classes, such as gold, commodities, and real estate investment trusts (REITs). Inflation-indexed bonds are another popular option for investors to profit from inflation.

High and variable rates of inflation can impose major costs on an economy. Businesses, workers, and consumers must all account for the effects of generally rising prices in their buying, selling, and planning decisions. This introduces an additional source of uncertainty in the economy, because they may guess wrong about the rate of future inflation. Time and resources expended on researching, estimating, and adjusting economic behaviour are expected to rise to the general level of prices. That’s opposed to real economic fundamentals, which inevitably represent a cost to the economy as a whole.

Even a low, stable, and easily predictable rate of inflation, which some consider otherwise optimal, may lead to serious problems in the economy. That’s because of how, where, and when the new money enters the economy. Whenever new money and credit enter the economy, it is always in the hands of specific individuals or business firms. The process of price level adjustments to the new money supply proceeds as they then spend the new money and it circulates from hand to hand and account to account through the economy.

Inflation does drive up some prices first and drives up other prices later. This sequential change in purchasing power and prices (known as the Cantillon effect) means that the process of inflation not only increases the general price level over time. But it also distorts relative prices, wages, and rates of return along the way. Economists, in general, understand that distortions of relative prices away from their economic equilibrium are not good for the economy, and Austrian economists even believe this process to be a major driver of cycles of recession in the economy.

Pros

- This leads to the higher resale value of assets

- Optimum levels of inflation encourage spending

Cons

- Buyers have to pay more for products and services

- Impose higher prices on economy

- Drives some prices up first and others later

Controlling Inflation

A country’s financial regulator shoulders the important responsibility of keeping inflation in check. It is done by implementing measures through monetary policy, which refers to the actions of a central bank or other committees that determine the size and rate of growth of the money supply.

In the U.S., the Fed’s monetary policy goals include moderate long-term interest rates, price stability, and maximum employment. Each of these goals is intended to promote a stable financial environment. The Federal Reserve clearly communicates long-term inflation goals in order to keep a steady long-term rate of inflation, which is thought to be beneficial to the economy.

Price stability—or a relatively constant level of inflation—allows businesses to plan for the future since they know what to expect. The Fed believes that this will promote maximum employment, which is determined by non-monetary factors that fluctuate over time and are therefore subject to change. For this reason, the Fed doesn’t set a specific goal for maximum employment, and it is largely determined by employers’ assessments. Maximum employment does not mean zero unemployment, as at any given time there is a certain level of volatility as people vacate and start new jobs.

Monetary authorities also take exceptional measures in extreme conditions of the economy. For instance, following the 2008 financial crisis, the U.S. Fed has kept the interest rates near zero and pursued a bond-buying program called quantitative easing (QE).13 Some critics of the program alleged it would cause a spike in inflation in the U.S. dollar, but inflation peaked in 2007 and declined steadily over the next eight years.14

There are many complex reasons why QE didn’t lead to inflation or hyperinflation, though the simplest explanation is that the recession itself was a very prominent deflationary environment, and quantitative easing supported its effects.

Consequently, U.S. policymakers have attempted to keep inflation steady at around 2% per year.15 The European Central Bank (ECB) has also pursued aggressive quantitative easing to counter deflation in the eurozone, and some places have experienced negative interest rates. That’s due to fears that deflation could take hold in the eurozone and lead to economic stagnation.16

Moreover, countries that are experiencing higher rates of growth can absorb higher rates of inflation. India’s target is around 4% (with an upper tolerance of 6% and a lower tolerance of 2%), while Brazil aims for 3.5% (with an upper tolerance of 5% and a lower tolerance of 2%).

Hedging Against Inflation

Stocks are considered to be the best hedge against inflation, as the rise in stock prices is inclusive of the effects of inflation. Since additions to the money supply in virtually all modern economies occur as bank credit injections through the financial system, much of the immediate effect on prices happens in financial assets that are priced in their home currency, such as stocks.

Special financial instruments exist that one can use to safeguard investments against inflation. They include Treasury Inflation-Protected Securities (TIPS), low-risk treasury security that is indexed to inflation where the principal amount invested is increased by the percentage of inflation.20

One can also opt for a TIPS mutual fund or TIPS-based exchange-traded fund (ETF). To get access to stocks, ETFs, and other funds that can help to avoid the dangers of inflation, you’ll likely need a brokerage account. Choosing a stockbroker can be a tedious process due to the variety among them.

Gold is also considered to be a hedge against inflation, although this doesn’t always appear to be the case looking backwards

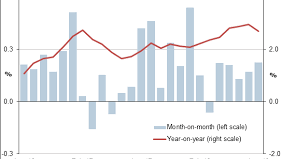

US Inflation Rate, April 2018–August 2022